[新しいコレクション] a public limited company raises its capital by selling shares to the public 826808-A public limited company raises its capital by selling shares to the public

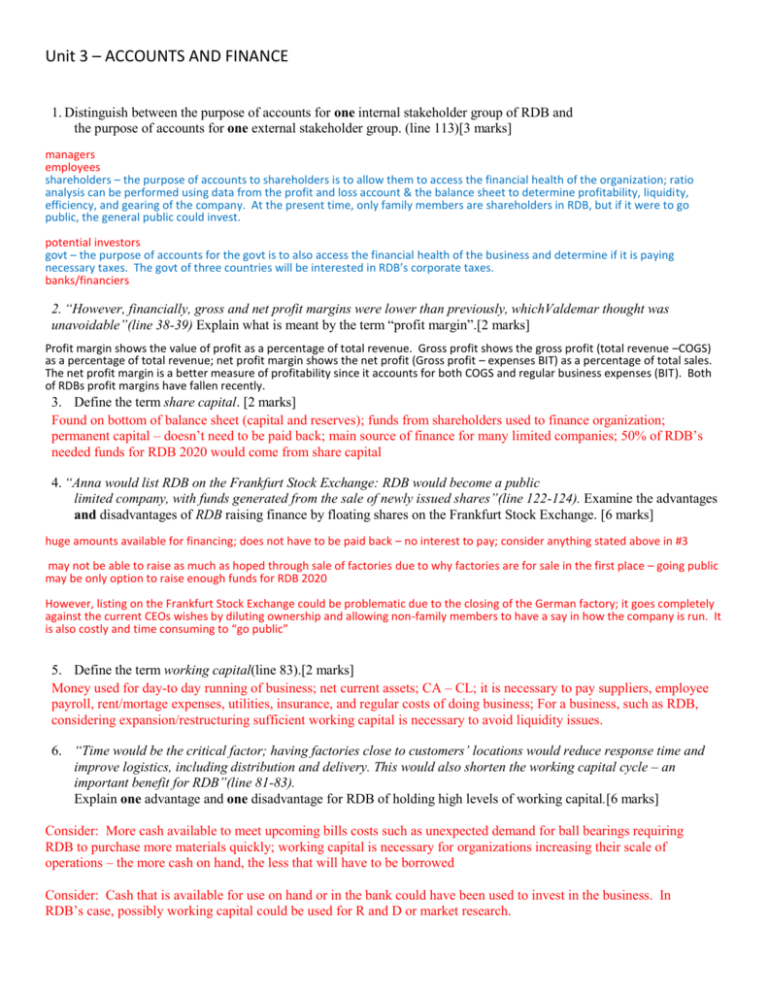

Start A Public Limited Company By Uks And Associates Issuu

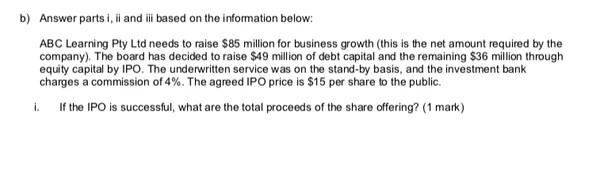

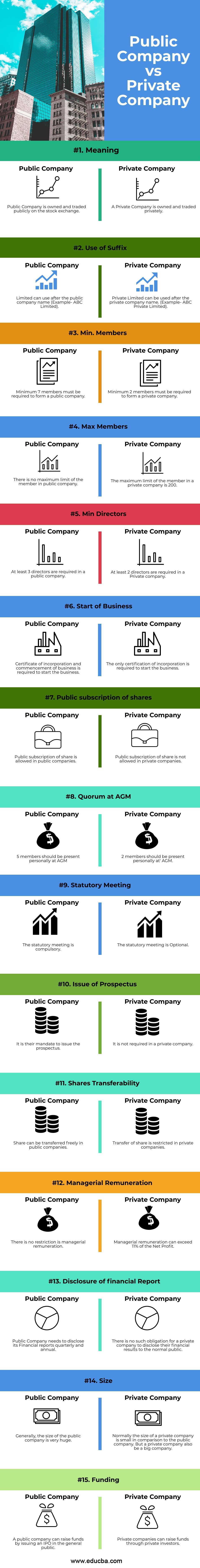

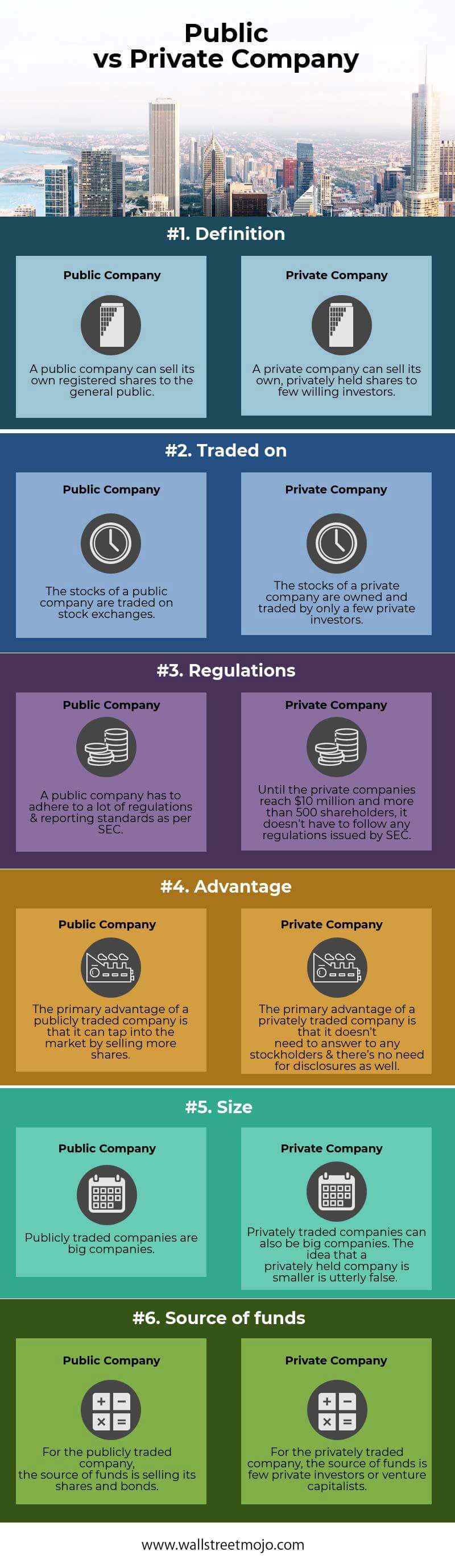

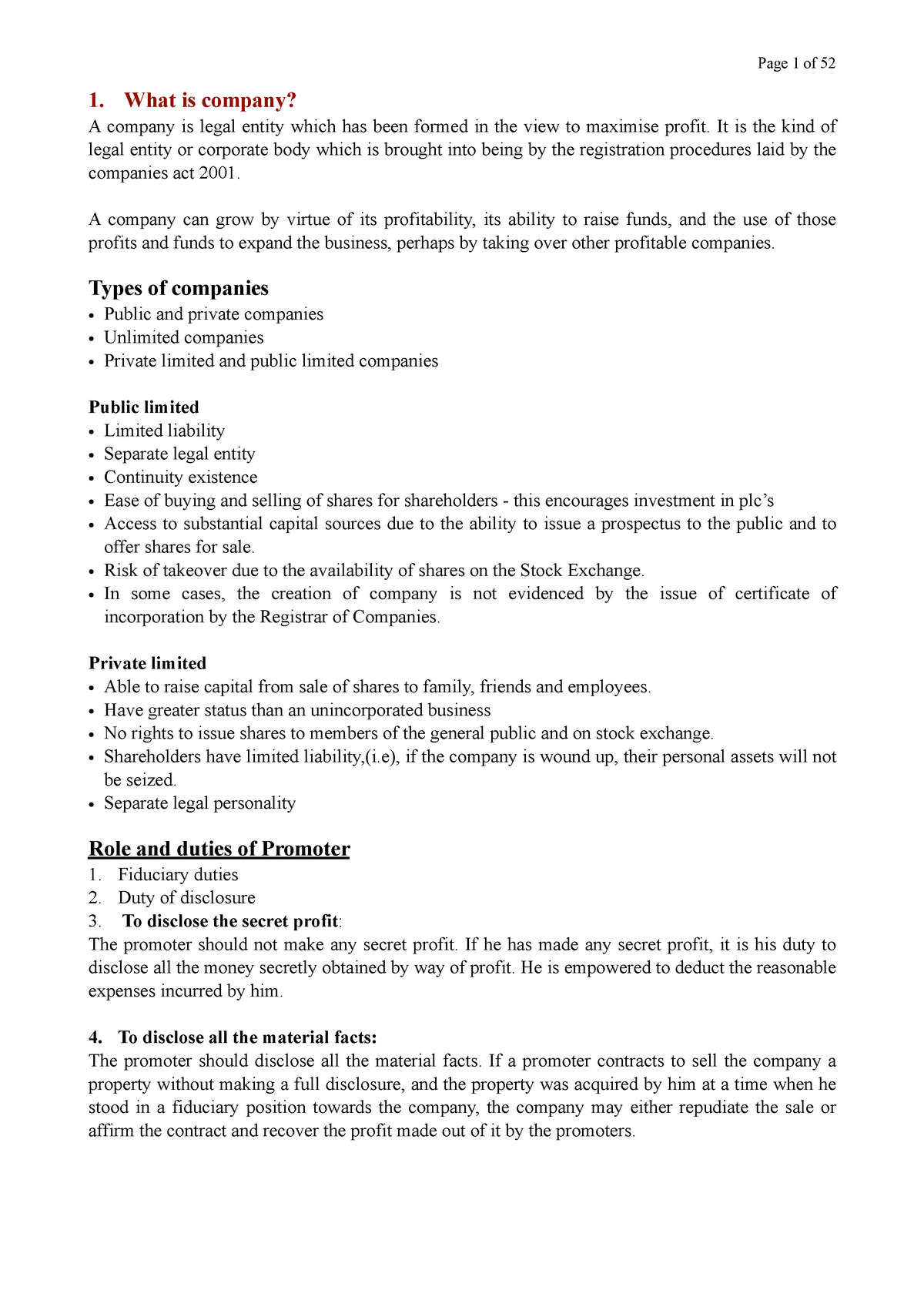

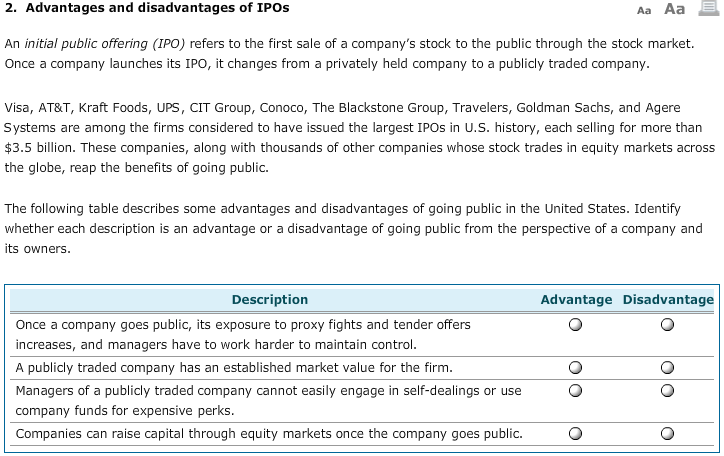

A corporation increases capitalization by selling shares of stock which can either come from a new issue or previously authorized but unissued shares Total stock outstanding must A)never equal the number of shares issued(ii) except in case of One Person Company, limits the number of its members to two hundred;

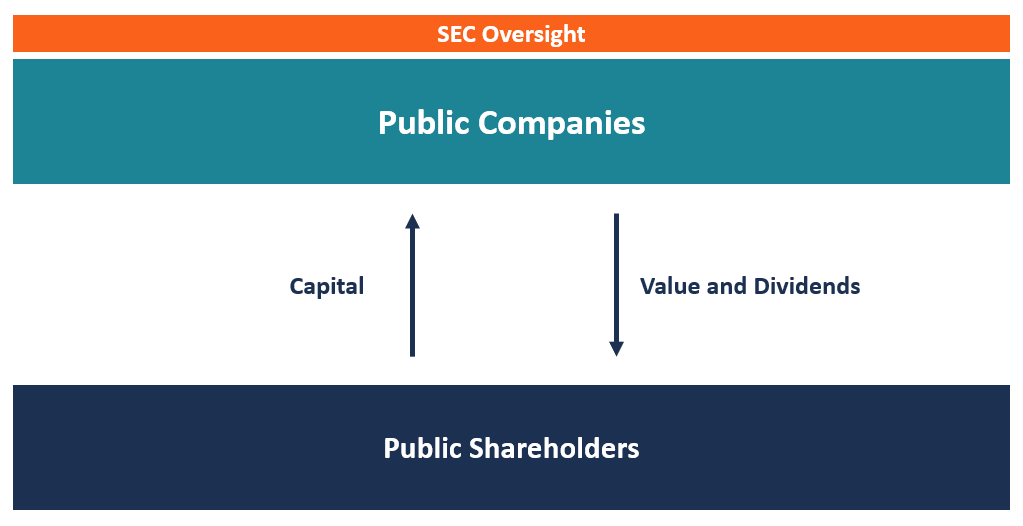

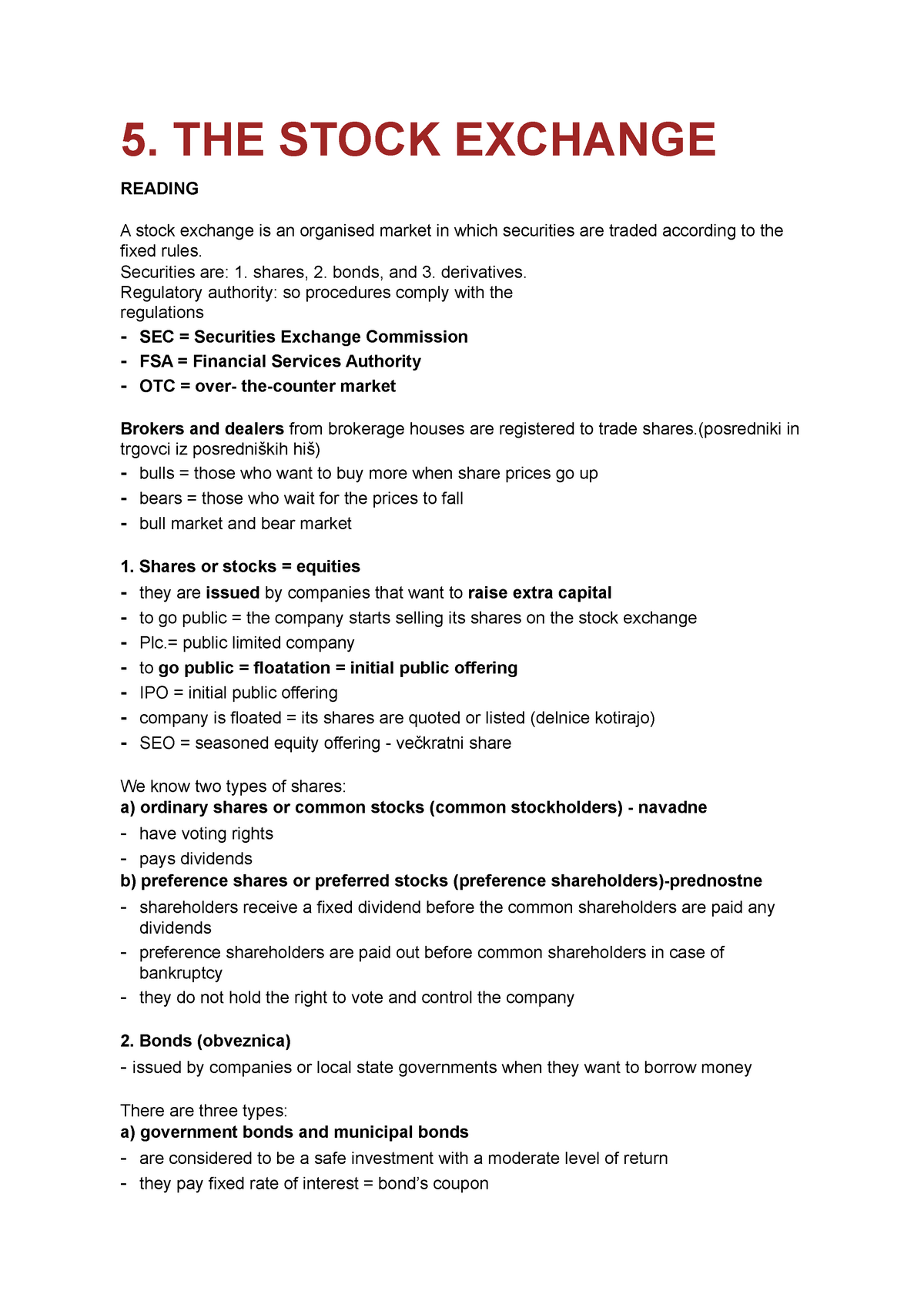

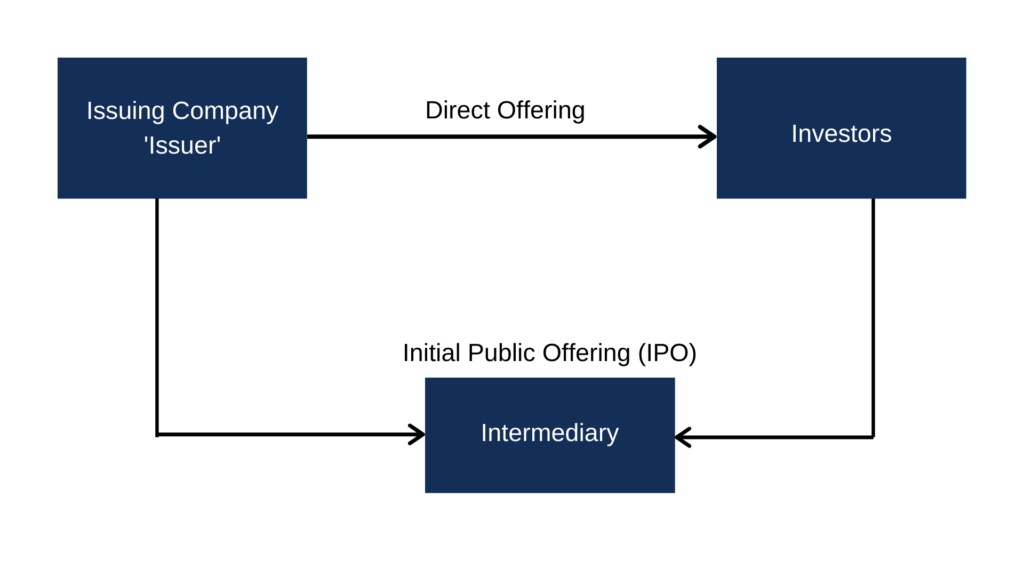

A public limited company raises its capital by selling shares to the public

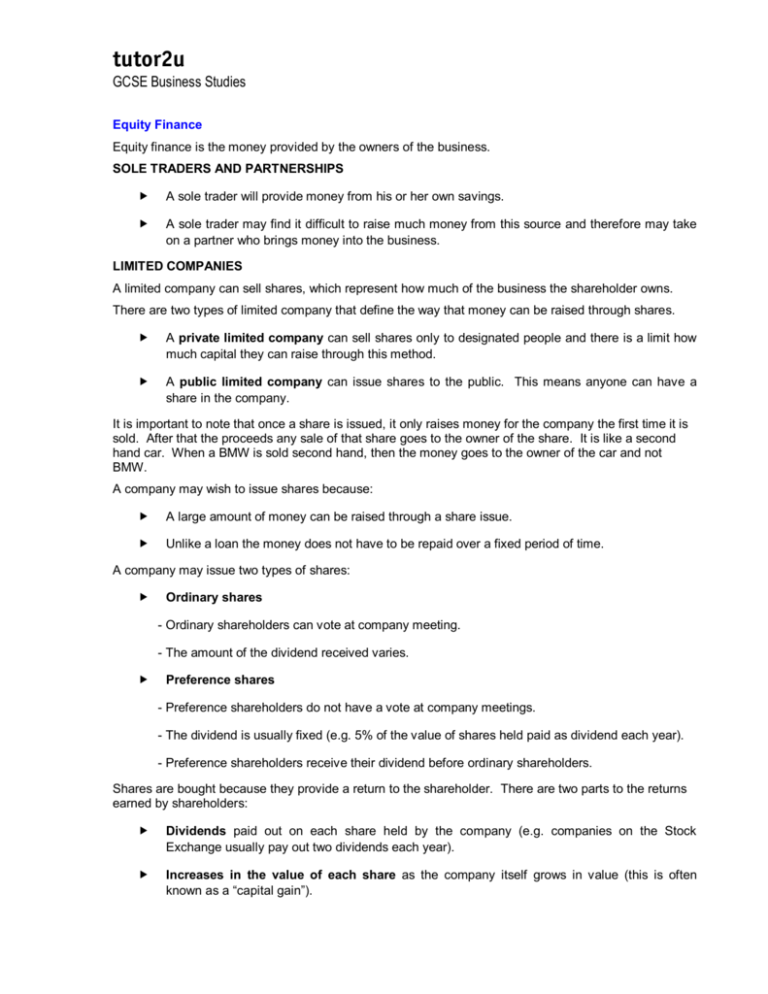

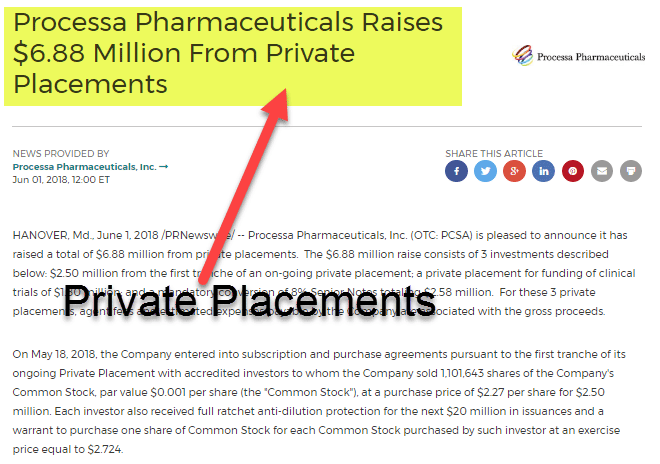

A public limited company raises its capital by selling shares to the public-There are a number of reasons why investors will buy shares of company stock, includingThis type of company can only be public A company limited by guarantee cannot issue shares Its members also do not receive dividends from profits This sort of company has no share capital and is unable to raise equity For this reason, businesses rarely use it

:max_bytes(150000):strip_icc()/SHAREBUYBACKFINALJPEGII-e9213e5fe3a9435b9d0cc4d33d33a591.jpg)

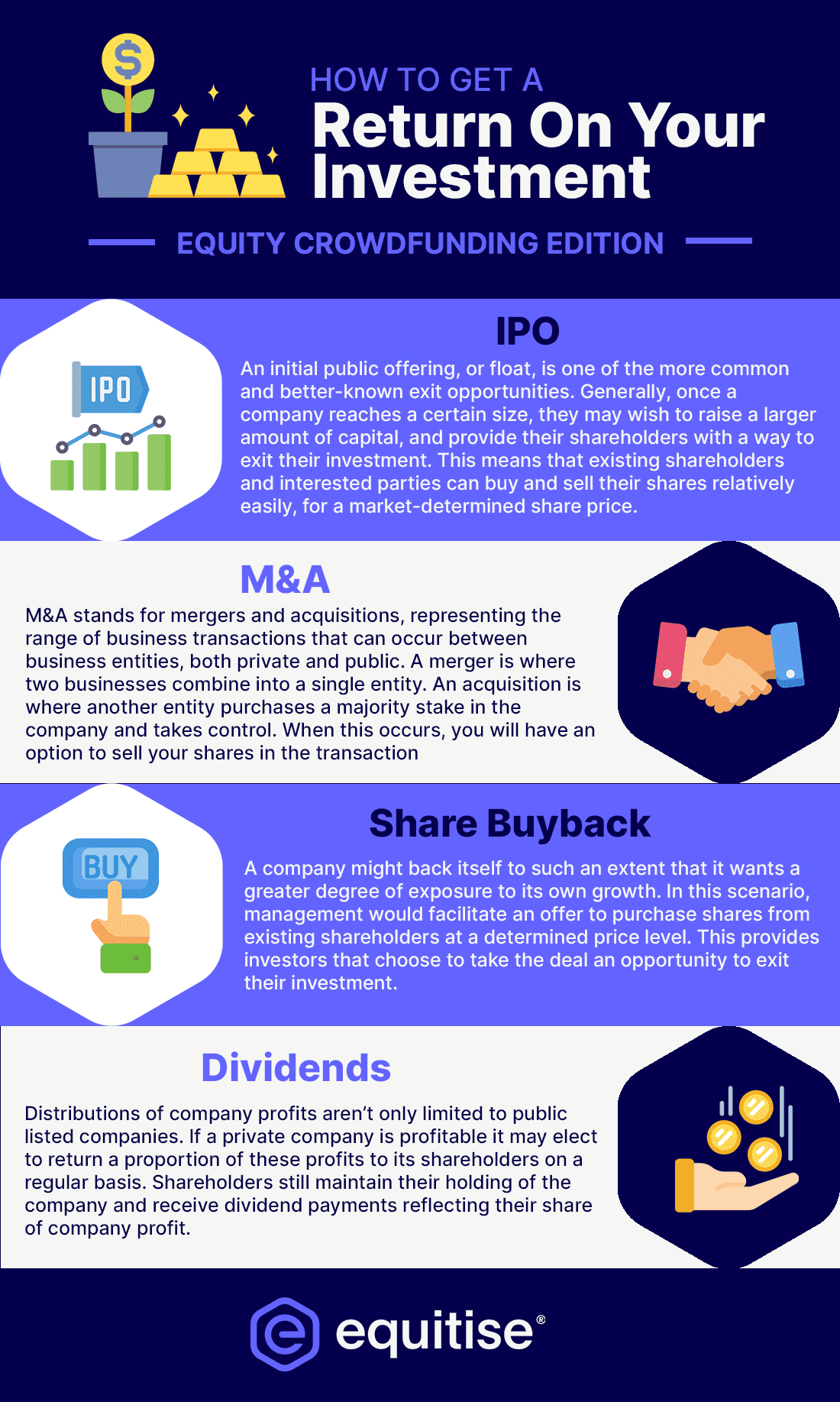

Stock Buybacks Why Do Companies Buy Back Shares

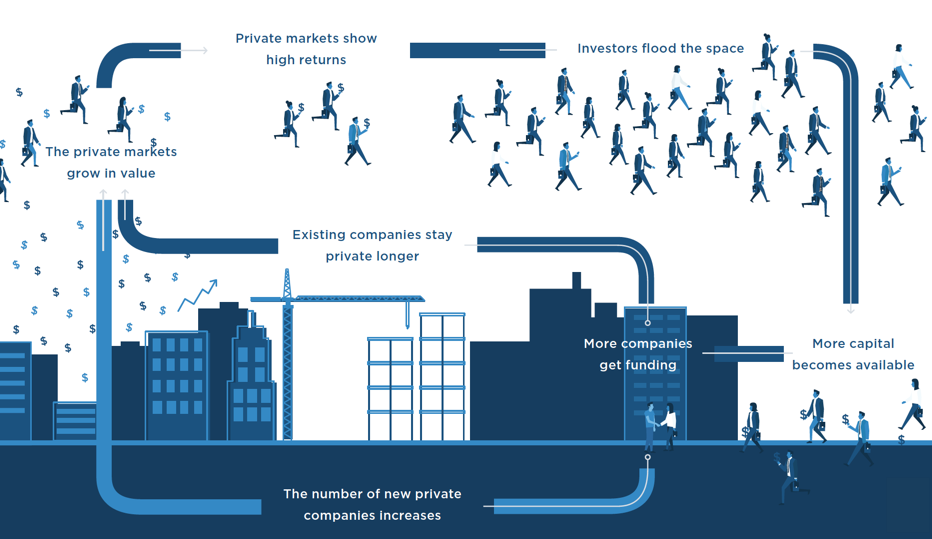

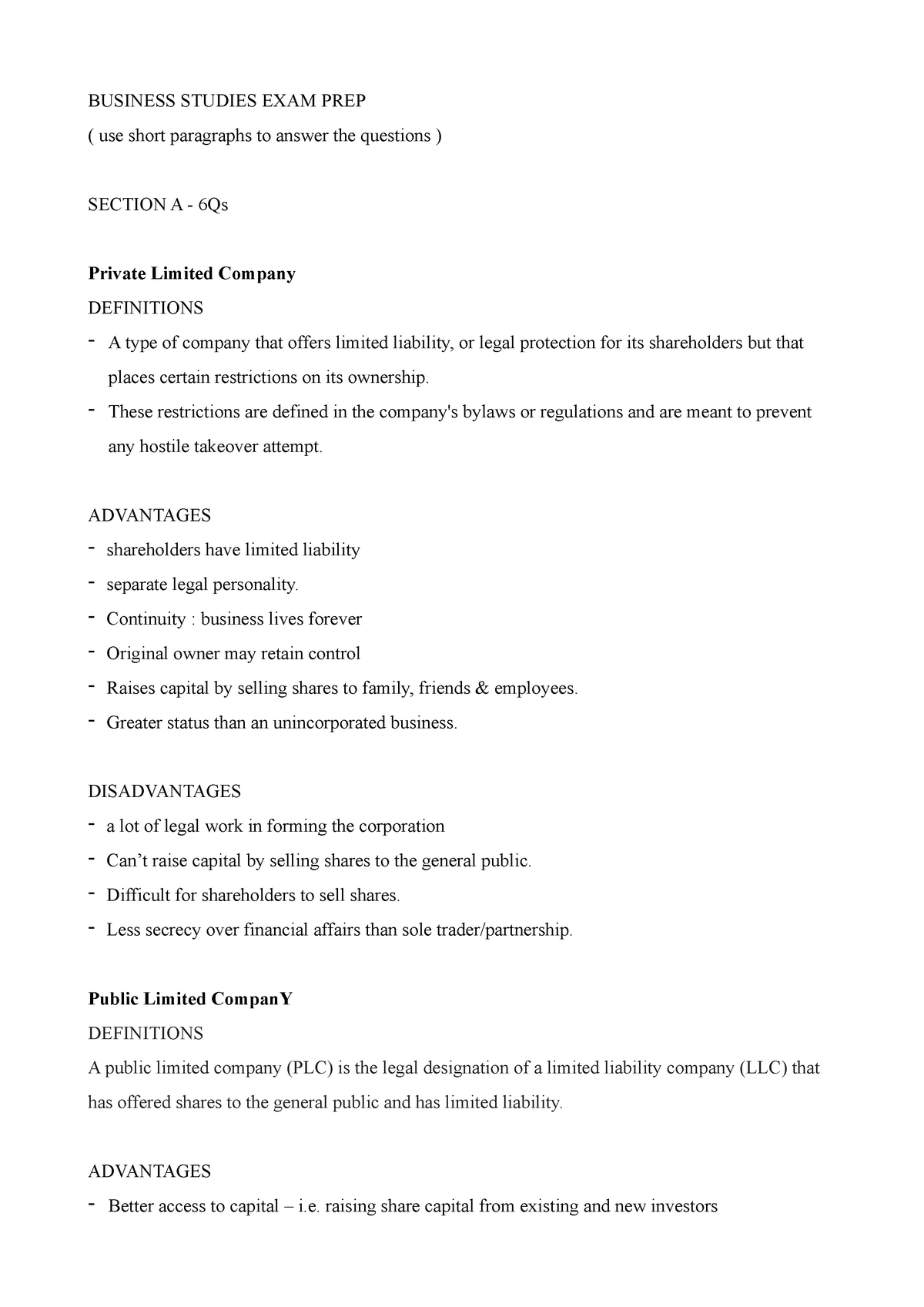

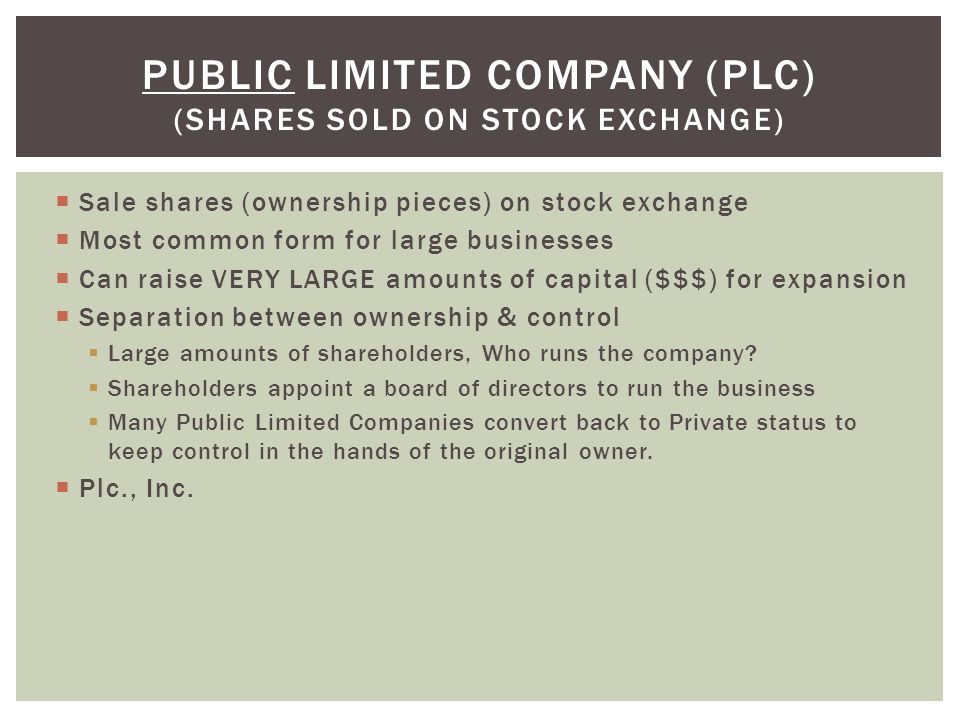

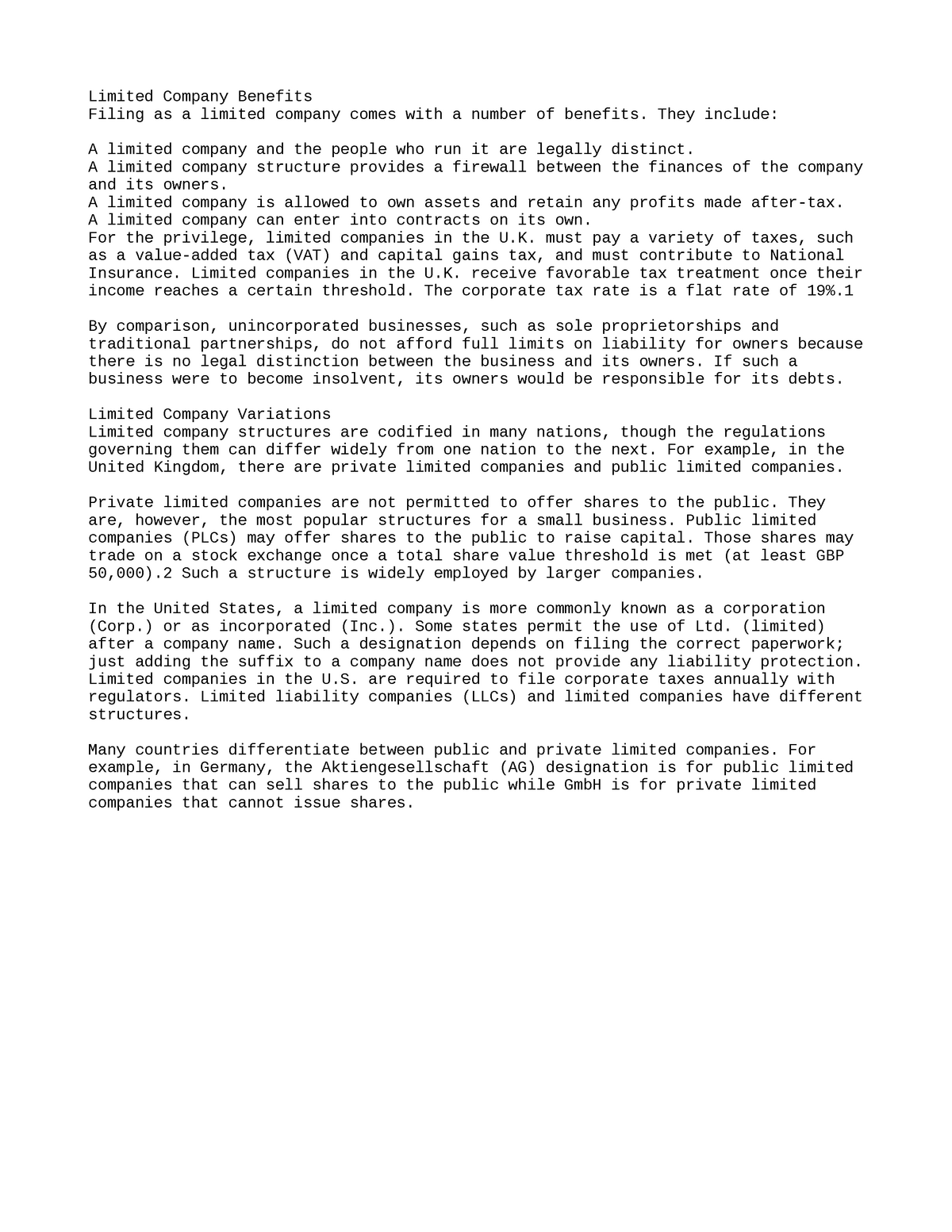

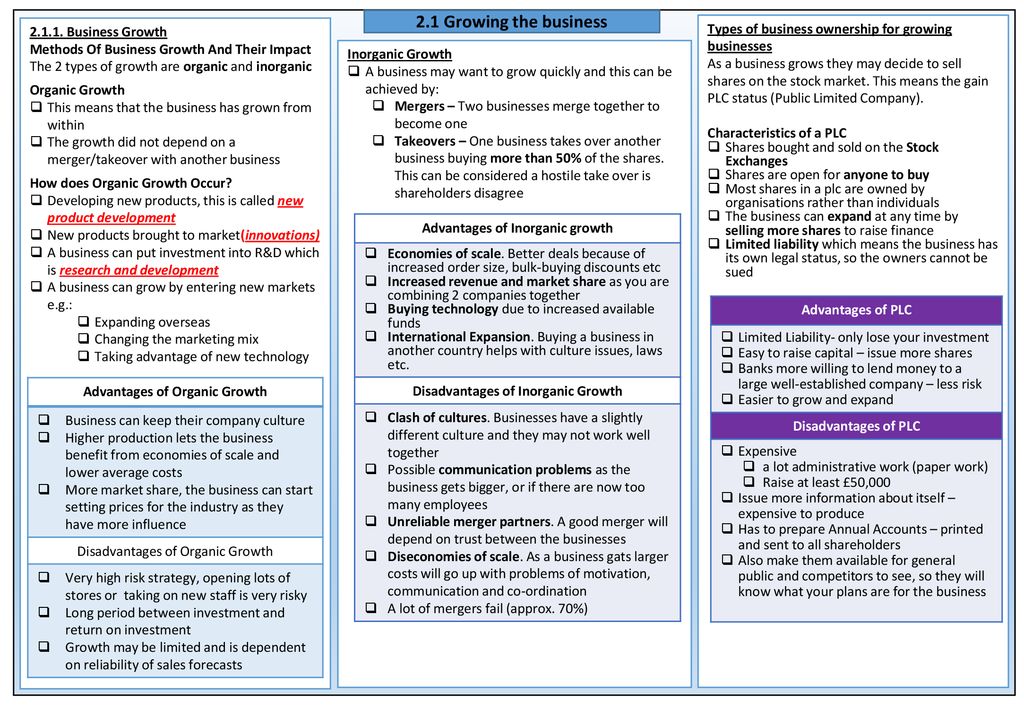

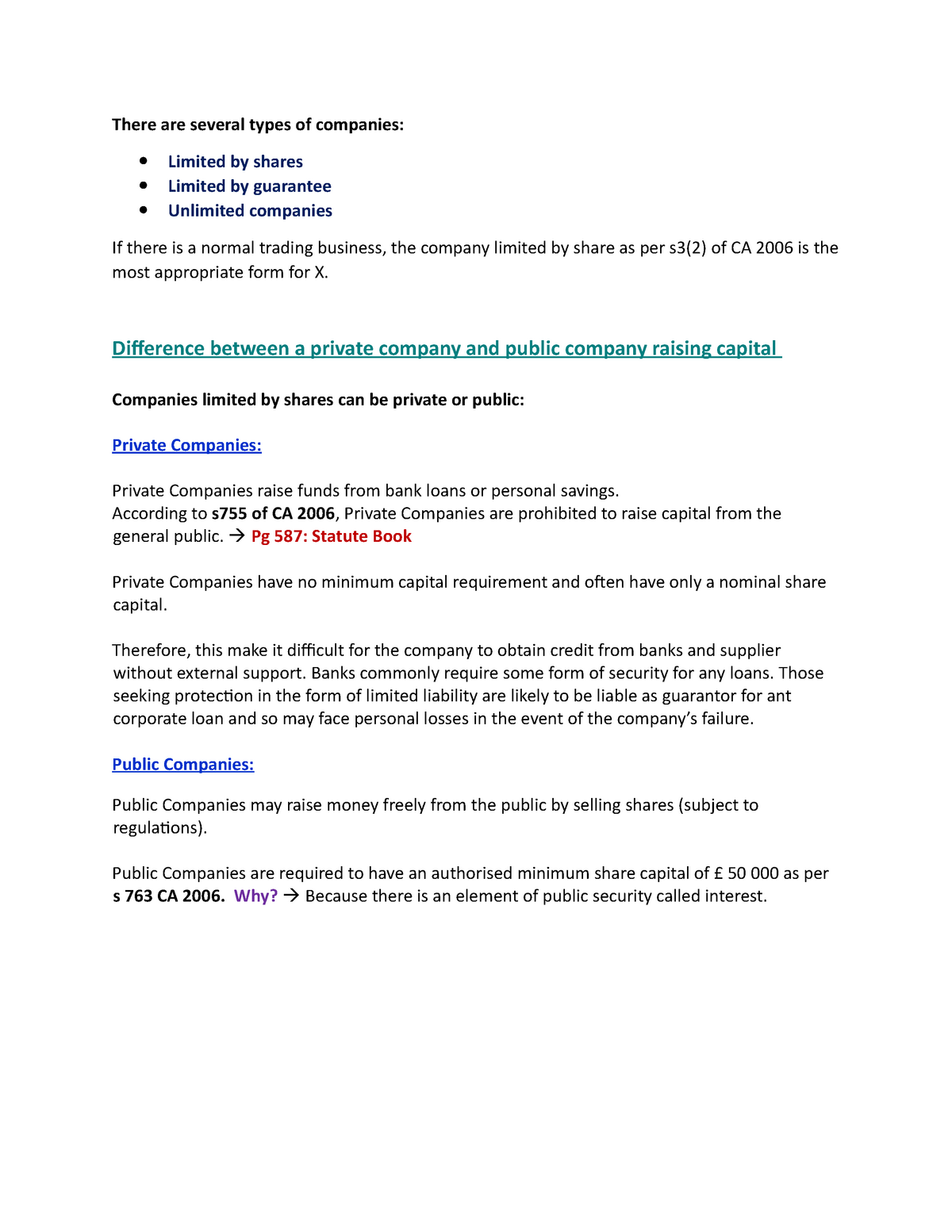

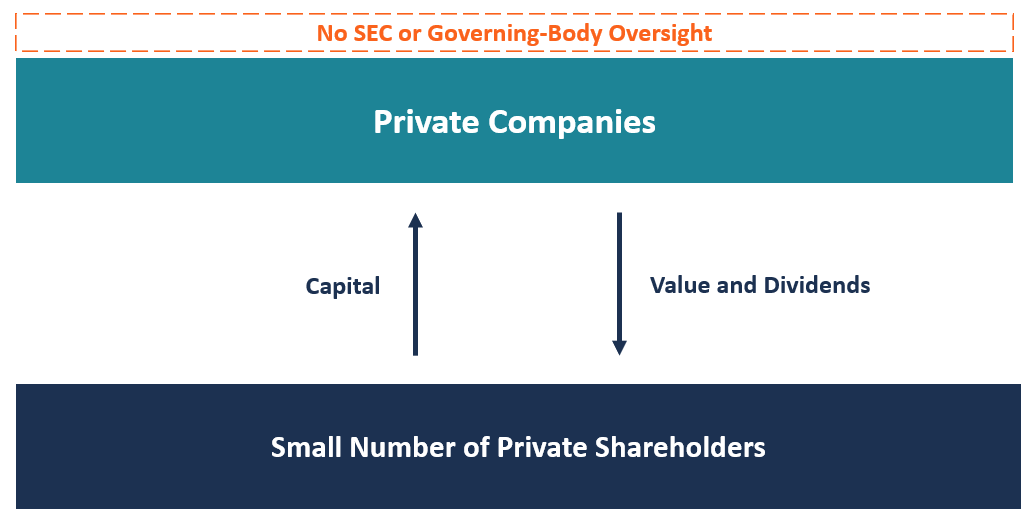

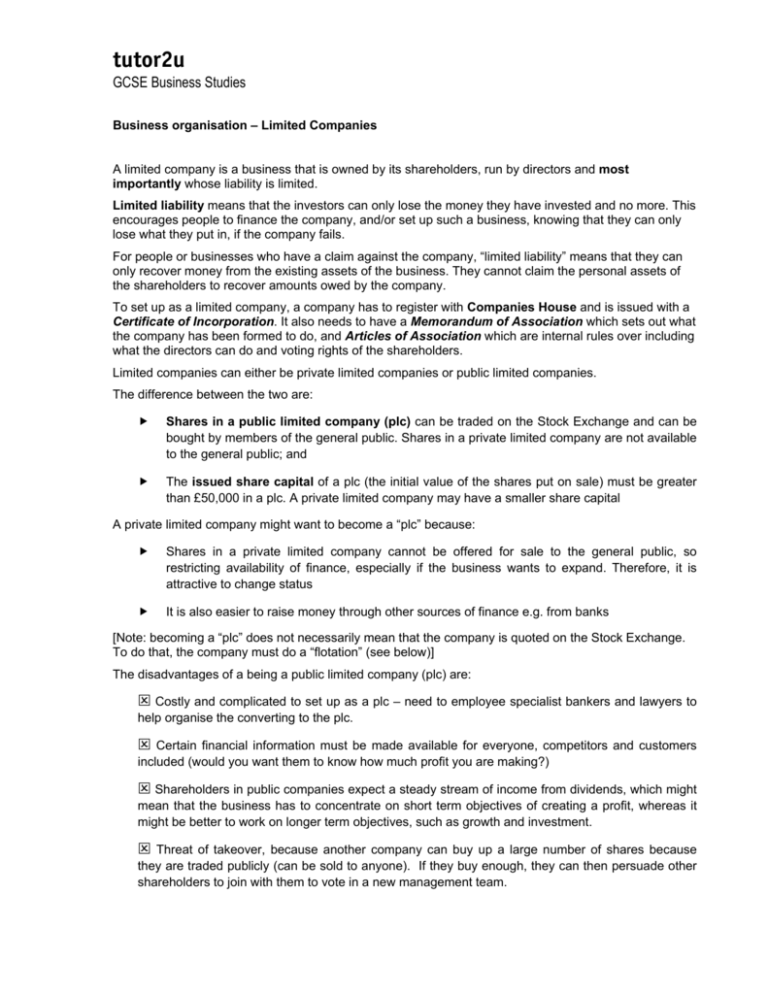

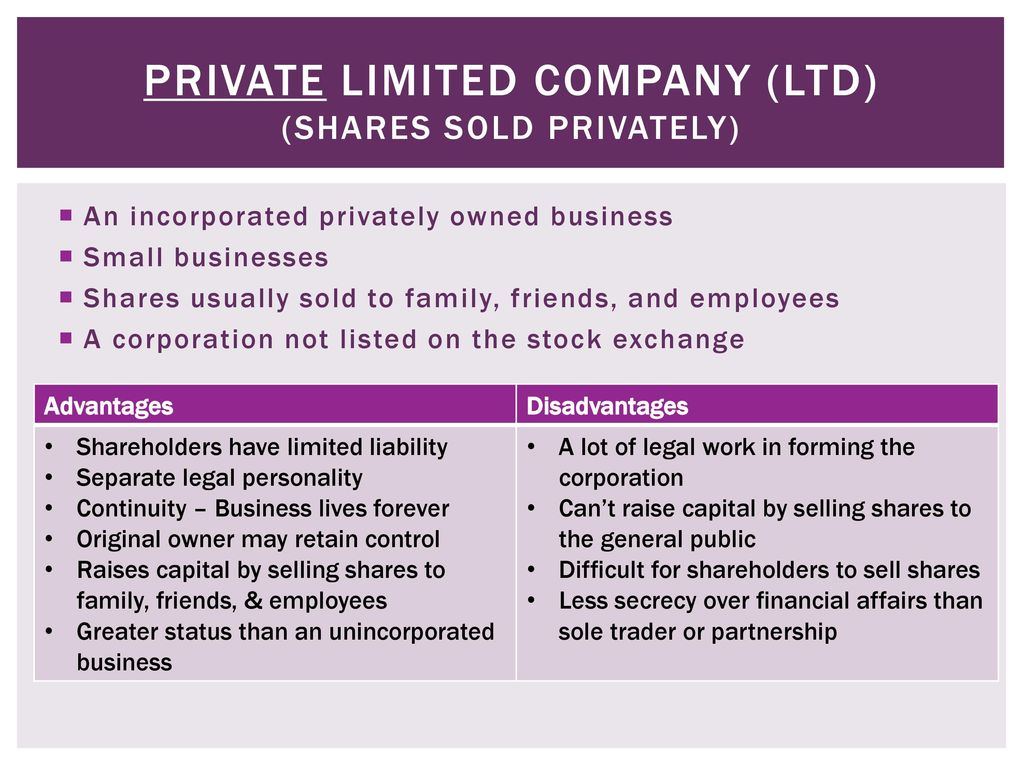

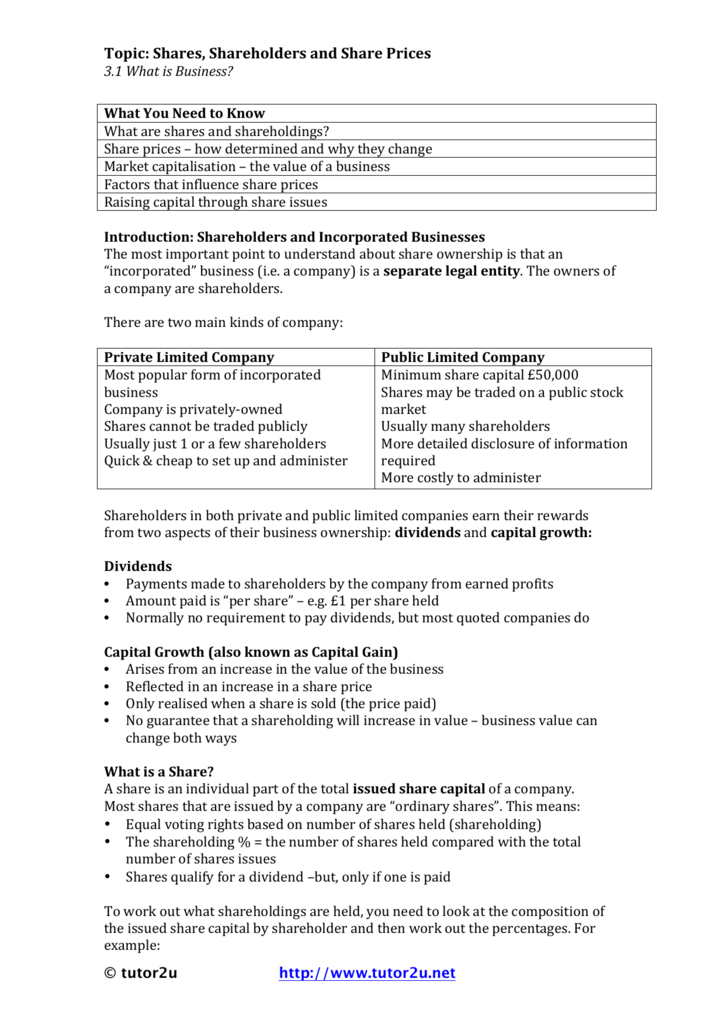

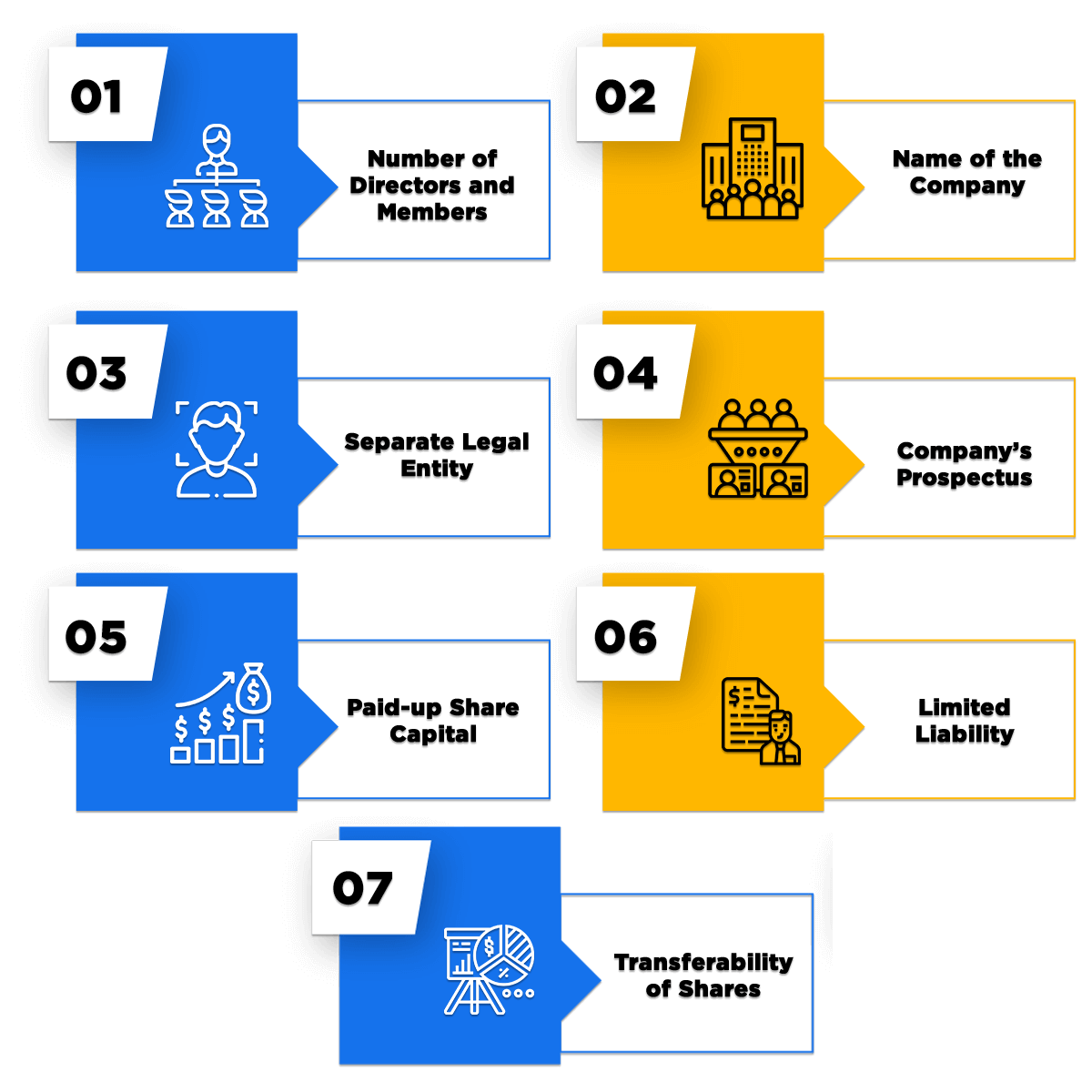

A private company limited by shares is a class of private limited company incorporated under the laws of England and Wales, Northern Ireland, Scotland, certain Commonwealth countries, and the Republic of IrelandIt has shareholders with limited liability and its shares may not be offered to the general public, unlike those of a public limited company The share capital in a private limited company is the amount of money invested by its owners in exchange for shares of ownership Company directors are typically shareholders in their own companies Shareholders exercise certain powers over how the company is run Share capital and company formation All companies limited by shares must have atCapital Gains Tax You may have made a 'capital gain' when selling the company (for example the money you get from the sale, or assets from it that you keep) If this means you need to pay

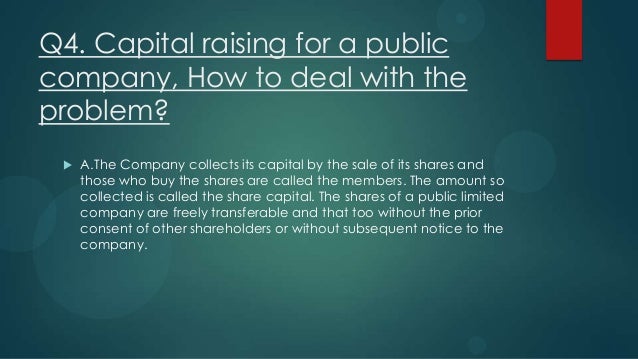

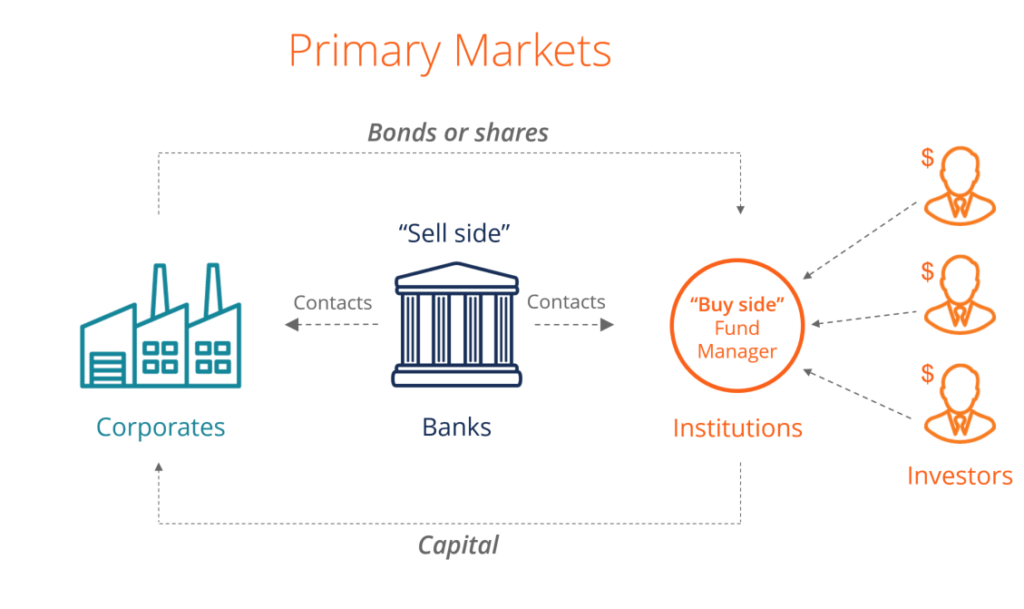

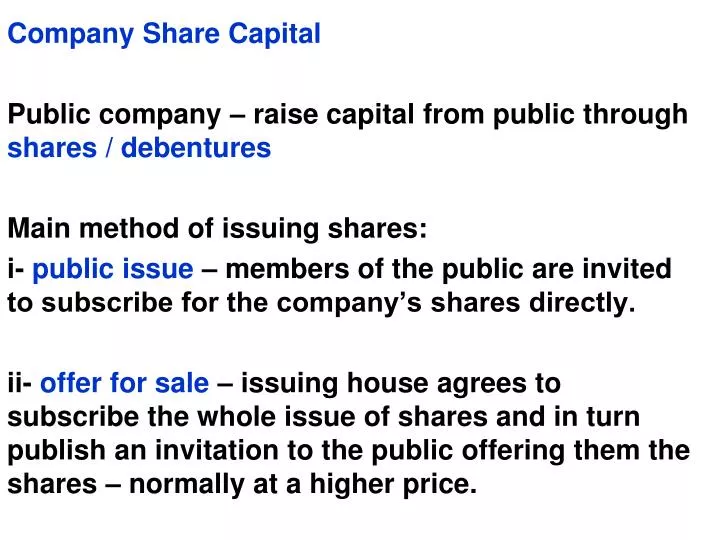

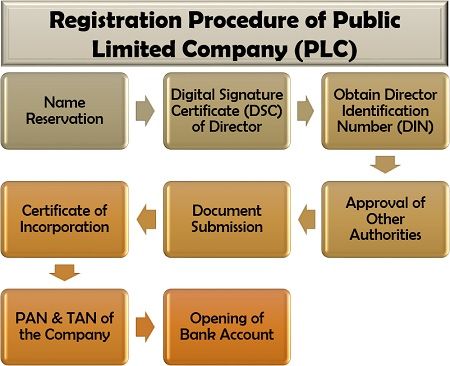

A public limited company ('PLC') is a company that is able to offer its shares to the publicThey don't have to offer those shares to the public, but they can Well over 95% of limited companies in the UK are "private" – it is by far the most common form of limited companyA private company does not have to offer up detailed information on how it's faring for public and government scrutiny, as do public companies under the regulations of the Securities and Exchange Commission Companies can go from private to public, by selling shares to the public, often as a way to raise a large amount of moneyA Public limited company has to secure minimum capital before allotting its shares There is no such restriction for a private limited company and it can allot shares 5 Issue of prospectus A public limited company can invite public to subscribe for its shares It must issue a prospectus or file a statement in lieu of prospectus before

A public limited company raises its capital by selling shares to the publicのギャラリー

各画像をクリックすると、ダウンロードまたは拡大表示できます

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

:max_bytes(150000):strip_icc()/dotdash-TheBalance-what-are-stocks-3306181-Final-75b1bb359b7141d9a22cb1b706f2cf2f.jpg) Venture Capital Wikipedia | Venture Capital Wikipedia | /dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg) Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia | /GettyImages-1291752704-556ddf53a21f47fd8c3345250278c936.jpg) Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia | /dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg) Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia | Venture Capital Wikipedia | Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia | Venture Capital Wikipedia | Venture Capital Wikipedia |

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg) Venture Capital Wikipedia |  Venture Capital Wikipedia | Venture Capital Wikipedia |

Venture Capital Wikipedia | :max_bytes(150000):strip_icc()/SHAREBUYBACKFINALJPEGII-e9213e5fe3a9435b9d0cc4d33d33a591.jpg) Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia | /GettyImages-694983373-8b2b19ffcb374422af1b198a0910f1e0.jpg) Venture Capital Wikipedia | /GettyImages-932632502-af06cb55e20b4fdc87993aa3b2270488.jpg) Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |  Venture Capital Wikipedia |

Venture Capital Wikipedia |  Venture Capital Wikipedia |

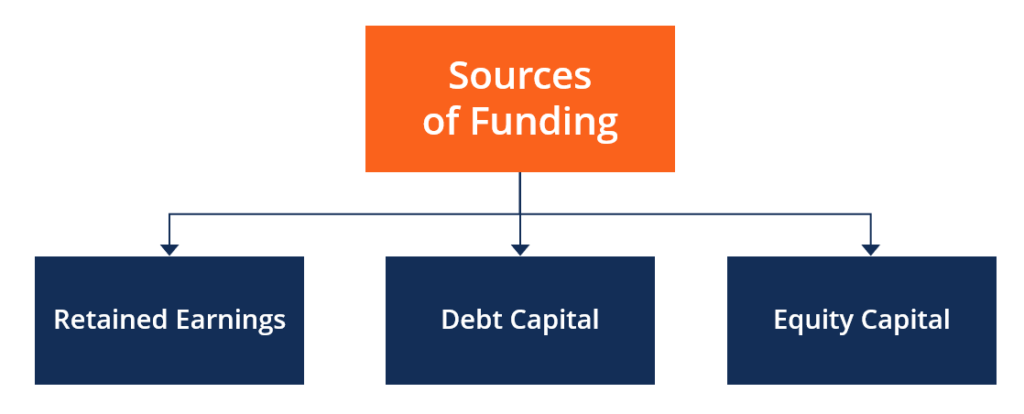

The public limited company has than capital which refers to the fund's arrangement by issuing shares in return for cash or other considerations The amount of share capital of a company can change over time because each time a business sells new shares to the public in exchange for cash, the amount of that capital will increaseThe main characteristic and advantage of a public limited company is that you can raise capital through external investors, in essence, offering shares in your company to the public To set up as a PLC you need to have at least two shareholders and at least £50,000 worth of shares must be issued, although there's no obligation for you to

Incoming Term: a public limited company raises its capital by selling shares to the public,

No comments: